Mitch McConnell, a prominent figure in American politics, has been a key player in discussions surrounding the repeal of real estate tax. His stance on this issue is not only significant for policymakers and real estate investors but also for everyday homeowners who could be affected by such legislative changes. The topic of real estate tax repeal is complex, involving numerous stakeholders and economic implications. McConnell's influence and legislative priorities have made him a central figure in these discussions, drawing attention to the intricacies of tax policy reform.

The idea of repealing real estate tax has been a contentious topic in the United States, with proponents arguing it could spur economic growth and provide relief to property owners, while opponents warn of potential revenue losses for local governments. As the Senate Minority Leader, Mitch McConnell's opinion holds substantial weight, and his advocacy for or against such measures can tip the scales in legislative debates. This article will delve into McConnell's biography, his political career, and his specific role and perspective on real estate tax repeal.

Understanding the potential impact of Mitch McConnell's views requires a deep dive into his political philosophy, his track record on tax-related issues, and the broader implications of repealing real estate tax. This comprehensive analysis will provide insights into the possible outcomes of such a repeal, considering economic, social, and political factors. Readers will gain a clearer picture of how McConnell's position could shape future legislative developments and affect various segments of the population.

Table of Contents

- Biography of Mitch McConnell

- Early Life and Education

- Political Career

- Influence on Tax Policy

- Real Estate Tax: An Overview

- Mitch McConnell and the Repeal of Real Estate Tax

- Economic Implications of Tax Repeal

- Social Impact of Repealing Real Estate Tax

- Political Repercussions

- Stakeholder Perspectives

- Future Outlook

- Frequently Asked Questions

- Conclusion

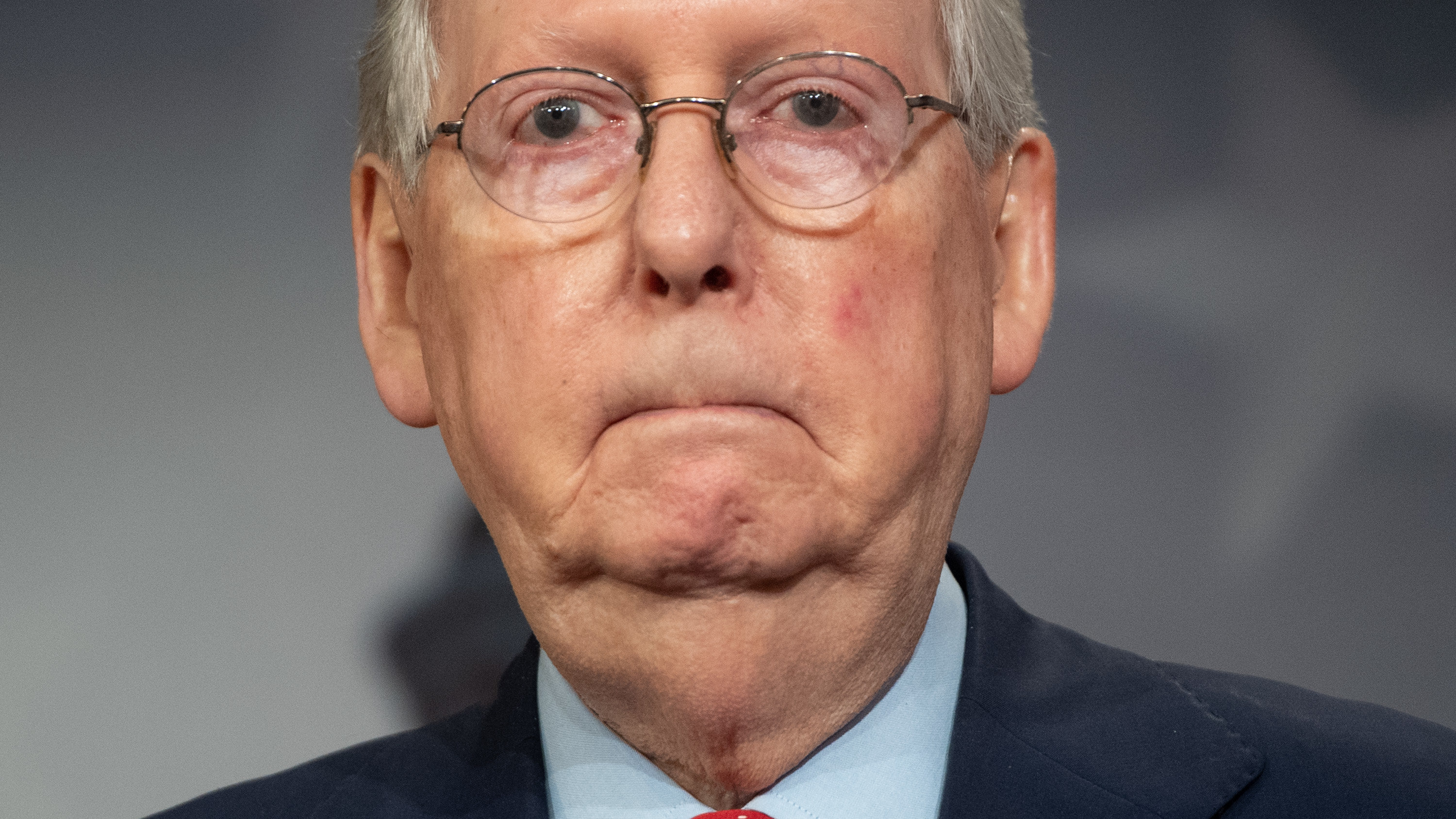

Biography of Mitch McConnell

Mitch McConnell, born Addison Mitchell McConnell Jr. on February 20, 1942, in Sheffield, Alabama, is a seasoned American politician serving as the senior United States Senator from Kentucky since 1985. He is a member of the Republican Party and has held several key leadership positions, including Senate Majority Leader from 2015 to 2021 and Senate Minority Leader since 2021. Known for his strategic acumen and legislative prowess, McConnell has been a significant force in shaping U.S. policy over the decades.

Personal Details and Bio Data

| Full Name | Addison Mitchell McConnell Jr. |

|---|---|

| Date of Birth | February 20, 1942 |

| Place of Birth | Sheffield, Alabama, USA |

| Political Party | Republican |

| Position | Senate Minority Leader |

| Education | University of Louisville (B.A.), University of Kentucky College of Law (J.D.) |

Early Life and Education

Mitch McConnell was raised in a middle-class family, experiencing firsthand the values of hard work and determination. His family relocated from Alabama to Louisville, Kentucky, when he was a young child. McConnell attended duPont Manual High School in Louisville, where he showed an early interest in leadership and governance, serving as the student body president.

He pursued higher education at the University of Louisville, earning a Bachelor of Arts in Political Science in 1964. McConnell's academic journey continued at the University of Kentucky College of Law, where he obtained his Juris Doctor in 1967. His education laid the foundation for his future career in law and politics, equipping him with the knowledge and skills necessary for legislative success.

Political Career

Mitch McConnell's political career began in earnest when he was elected as a County Judge/Executive of Jefferson County, Kentucky, in 1977. His tenure demonstrated his ability to navigate complex political landscapes and build consensus among diverse stakeholders. In 1984, McConnell ran for the U.S. Senate and won, marking the beginning of a long and influential career in federal politics.

Throughout his time in the Senate, McConnell has been known for his pragmatic approach and commitment to conservative principles. He played a pivotal role in numerous legislative battles, including the confirmation of Supreme Court justices and the implementation of tax reforms. His strategic leadership and negotiation skills have earned him a reputation as a formidable political figure.

Influence on Tax Policy

Mitch McConnell has been instrumental in shaping tax policy in the United States, advocating for measures that align with his party's fiscal philosophy. As a proponent of lower taxes and reduced government spending, McConnell has consistently supported tax cuts and reforms aimed at stimulating economic growth. His influence extends to both domestic and international tax policy, often emphasizing the importance of competitive tax rates to attract business investment.

McConnell's involvement in tax policy discussions has been marked by his ability to mobilize support among his colleagues and constituents. His leadership during the passage of the Tax Cuts and Jobs Act of 2017 exemplifies his commitment to tax reform, highlighting his capacity to drive significant legislative achievements. McConnell's stance on tax matters continues to be a focal point of his political agenda.

Real Estate Tax: An Overview

Real estate tax, commonly known as property tax, is a levy imposed by local governments on the value of real property. This tax is a crucial source of revenue for municipalities, funding essential services such as education, public safety, and infrastructure maintenance. The calculation of real estate tax is based on the assessed value of the property, which is determined by local assessors.

Proponents of real estate tax argue that it is a stable and predictable source of income for local governments, allowing them to provide services that benefit the community. However, critics contend that high property taxes can burden homeowners, particularly those on fixed incomes, and may discourage real estate investment. The debate over real estate tax is ongoing, with various stakeholders advocating for reform or repeal.

Mitch McConnell and the Repeal of Real Estate Tax

The issue of repealing real estate tax has garnered attention in political circles, and Mitch McConnell's position on the matter is of particular interest. As a senior Republican leader, McConnell's views on tax policy can influence legislative priorities and drive discussions on potential reforms. While McConnell has not explicitly called for the repeal of real estate tax, his advocacy for tax reduction and reform suggests a potential openness to exploring changes in this area.

McConnell's approach to real estate tax repeal would likely involve a careful consideration of the economic and fiscal implications. He may weigh the potential benefits of reducing the tax burden on property owners against the need to maintain funding for essential services. McConnell's legislative strategy would be informed by his broader goals of promoting economic growth and ensuring fiscal responsibility.

Economic Implications of Tax Repeal

The repeal of real estate tax could have significant economic implications, influencing property values, investment decisions, and local government finances. Proponents argue that eliminating the tax could stimulate the real estate market by reducing the cost of property ownership, potentially leading to increased demand and higher property values. This, in turn, could encourage new construction and development, boosting economic activity.

However, opponents caution that the loss of real estate tax revenue could strain local budgets, necessitating cuts to public services or the implementation of alternative revenue measures. The economic impact of tax repeal would vary across regions, depending on factors such as local property values, government spending priorities, and the availability of alternative funding sources. Policymakers must carefully assess these variables to determine the feasibility and desirability of real estate tax repeal.

Social Impact of Repealing Real Estate Tax

The social impact of repealing real estate tax is another critical consideration in the debate. The tax plays a role in funding services that benefit the community, such as public education, healthcare, and social welfare programs. Eliminating this source of revenue could affect the quality and availability of these services, with potential consequences for vulnerable populations.

Advocates for tax repeal argue that the reduction in property tax burden could provide financial relief to homeowners, particularly those on fixed incomes or facing economic hardships. This could improve housing affordability and stability, contributing to greater social equity. However, the challenge lies in balancing these benefits with the need to ensure adequate funding for public services that support community well-being.

Political Repercussions

The political repercussions of repealing real estate tax are significant, as the issue is likely to provoke strong opinions and debate among lawmakers, constituents, and interest groups. Mitch McConnell's stance on tax repeal could influence the Republican Party's platform and legislative priorities, shaping the party's approach to fiscal policy and government spending.

Real estate tax repeal could also become a focal point in electoral campaigns, with candidates and political parties using the issue to differentiate themselves and appeal to voters. McConnell's leadership and strategic positioning on this topic could impact his political capital and relationships with key stakeholders, including fellow lawmakers, constituents, and advocacy organizations.

Stakeholder Perspectives

The debate over real estate tax repeal involves a wide range of stakeholders, each with distinct perspectives and interests. Homeowners, real estate investors, local governments, and advocacy groups all have a stake in the outcome of this issue, and their views must be considered in any policy discussions.

Homeowners and real estate investors may support tax repeal as a means of reducing costs and increasing property values. Local governments, however, may be concerned about the potential loss of revenue and the impact on public services. Advocacy groups may focus on the social implications of tax repeal, advocating for policies that ensure equitable access to essential services. Understanding these diverse perspectives is crucial for developing balanced and effective policy solutions.

Future Outlook

The future outlook for real estate tax repeal is uncertain, with economic, political, and social factors influencing the trajectory of this issue. Mitch McConnell's role as a key political leader will be instrumental in shaping the legislative agenda and determining the viability of tax repeal proposals.

As policymakers consider the potential benefits and challenges of real estate tax repeal, they must weigh the interests of various stakeholders and assess the broader economic and fiscal implications. The outcome of these discussions will have significant consequences for property owners, local governments, and the wider community, underscoring the importance of informed and strategic decision-making.

Frequently Asked Questions

What is Mitch McConnell's position on real estate tax repeal?

Mitch McConnell has not explicitly called for the repeal of real estate tax, but his advocacy for tax reduction and reform suggests a potential openness to exploring changes in this area.

How could the repeal of real estate tax impact homeowners?

The repeal could reduce the tax burden on property owners, potentially increasing housing affordability and property values. However, it could also lead to cuts in public services funded by real estate tax revenue.

What are the potential economic implications of repealing real estate tax?

Eliminating real estate tax could stimulate the real estate market and boost economic activity, but it may also strain local government budgets and necessitate alternative revenue measures.

How might real estate tax repeal affect public services?

The loss of real estate tax revenue could impact the quality and availability of public services such as education, healthcare, and infrastructure, affecting community well-being.

What are the political implications of real estate tax repeal?

The issue could provoke debate among lawmakers and become a focal point in electoral campaigns, influencing party platforms and legislative priorities.

Who are the key stakeholders in the real estate tax repeal debate?

Key stakeholders include homeowners, real estate investors, local governments, advocacy groups, and policymakers, each with distinct perspectives and interests in the outcome.

Conclusion

The topic of real estate tax repeal is complex and multifaceted, involving economic, social, and political considerations. Mitch McConnell's stance on this issue is significant, given his influential role in shaping U.S. policy. While the future of real estate tax repeal remains uncertain, the ongoing debate highlights the need for thoughtful and strategic decision-making that balances the interests of diverse stakeholders and addresses the broader implications for communities and the economy.

For more information on tax policy and legislative developments, readers can refer to resources such as the Tax Foundation (https://taxfoundation.org), which provides comprehensive analysis and insights on tax-related issues.