The financial valuation of Bob Ross's company, reflecting its assets, liabilities, and equity, is a crucial aspect of understanding its historical and current state. This metric provides insights into the company's overall health, profitability, and investment potential.

Understanding this figure can be significant for various stakeholders, including investors, creditors, and enthusiasts. For investors, it offers a snapshot of the company's financial performance and potential return. Creditors are interested in the company's ability to meet its financial obligations. Enthusiasts might be interested in the company's ongoing viability and the future of its legacy. A substantial net worth suggests the company is well-positioned, while a declining figure could raise concerns. This number, however, must be viewed in the context of the specific industry and overall economic conditions.

A comprehensive analysis of the company's financial performance is necessary for a deeper dive into this metric. This includes an examination of revenue streams, operating expenses, investment strategies, and other relevant financial data.

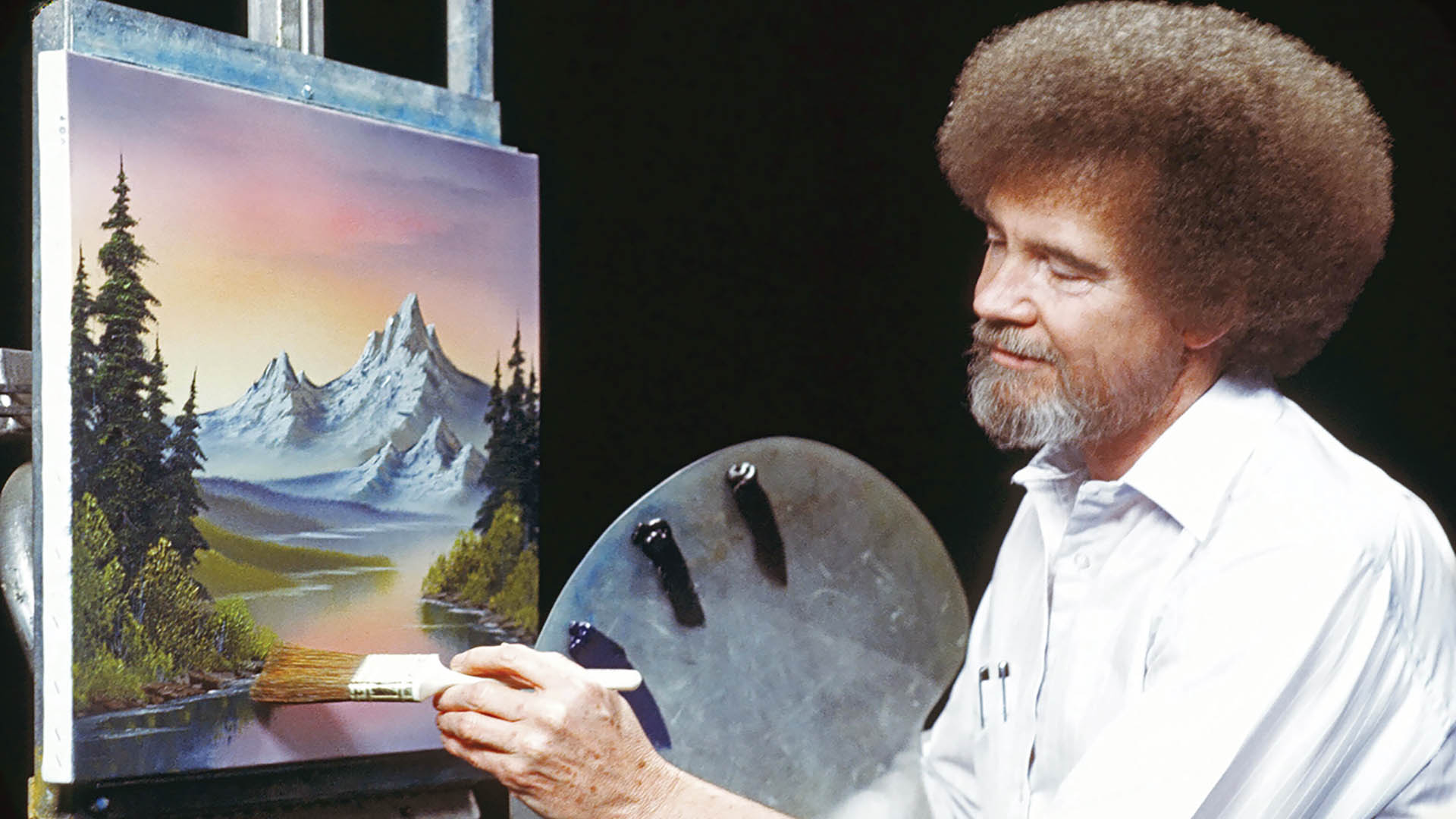

Bob Ross Inc. Net Worth

Understanding the financial health of Bob Ross Inc. requires examining key aspects beyond a simple numerical figure. This includes assessing revenue, assets, and liabilities, along with investment strategies and historical performance.

- Revenue streams

- Asset valuation

- Liability assessment

- Profitability

- Investment returns

- Market trends

- Historical context

Bob Ross Inc.'s net worth is a complex reflection of its past performance and future potential. Revenue streams, like merchandise sales and licensing, significantly impact the figure. Asset valuation, including intellectual property (like the Bob Ross brand itself), contributes significantly. Conversely, liabilities such as debts or legal obligations must be considered. Profitability and investment returns offer crucial insights into the company's ability to grow and sustain its value. Market trends and historical context help provide a wider picture by showing how comparable companies have performed in similar environments. Careful consideration of each of these factors is critical to a complete understanding of the overall financial picture.

1. Revenue Streams

Revenue streams directly influence Bob Ross Inc.'s net worth. A robust and diversified revenue portfolio generates higher income, contributing to a larger net worth. Conversely, a narrow or declining revenue stream potentially hinders net worth growth or even leads to a decrease. The specific types of revenue, such as licensing fees for merchandise, streaming rights, or online sales, each have different characteristics and impact on the overall financial health. Examples of how revenue impacts net worth are readily available in industry analyses of comparable companies. Strong revenue growth often correlates with increasing net worth, while stagnating or declining revenue usually results in a less positive net worth trend.

The importance of revenue streams as a component of net worth is substantial. Revenue serves as the primary source of income. Adequate revenue translates to higher profits, which in turn can be reinvested to expand the business or used to reduce debt. Increased profitability directly contributes to increased net worth. For example, successful licensing agreements for Bob Ross-branded merchandise can significantly boost revenue and subsequently, net worth. Conversely, failure to diversify revenue streams, particularly if reliant on a single product or market, creates vulnerabilities. This dependence could make the company susceptible to market downturns or competitor pressures, potentially affecting the net worth negatively.

Understanding the link between revenue streams and net worth is vital for stakeholders. Investors, for instance, analyze revenue patterns to assess the future financial health and growth prospects of Bob Ross Inc. A detailed examination of the company's revenue streams allows for a more accurate prediction of future net worth. Identifying potential risks and opportunities within the company's revenue streams is crucial to strategizing for future growth and maintaining a healthy net worth.

2. Asset Valuation

Asset valuation plays a critical role in determining Bob Ross Inc.'s net worth. The value of assets owned by the company directly contributes to the overall financial standing. A company's assets encompass a wide range of items, including tangible items like physical property and equipment, and intangible assets such as intellectual property. The valuation of these assets is not static; market conditions, economic fluctuations, and the specific nature of the asset significantly affect its value. Accurate asset valuation is paramount; an overestimation or underestimation directly distorts the calculated net worth.

Consider the value of the Bob Ross brand itself. As an intangible asset, its value stems from its brand recognition, consumer loyalty, and historical significance. Changes in public perception, shifts in consumer preferences, or the emergence of competitors can affect the perceived value of the brand. Likewise, the valuation of merchandise and licensing agreements directly affects net worth. A successful licensing deal can increase the value of the company's assets, whereas failing to renew or secure new licenses can lead to a decline in asset valuation and subsequently impact net worth. The worth of intellectual property, like copyrights and trademarks, is a pivotal part of the company's asset base and its overall financial strength. Successful preservation and utilization of these assets are crucial to sustainable growth and maintaining a robust net worth.

Understanding the relationship between asset valuation and net worth is crucial for various stakeholders. Investors assess the value of assets to gauge the company's financial strength and future potential. Accurate valuation allows investors to make informed decisions. Similarly, accurate valuations are essential for creditors in evaluating the company's ability to meet its financial obligations. A significant undervaluation of assets could trigger concern for creditors. For Bob Ross Inc. itself, precise asset valuation provides a realistic picture of its financial position, which is fundamental to strategic planning and decision-making.

3. Liability Assessment

Liability assessment is intrinsically linked to a company's net worth. Liabilities represent a company's financial obligations, such as debts, outstanding payments, and potential legal liabilities. A comprehensive assessment of liabilities is essential for accurately determining net worth. A high level of liabilities can significantly reduce net worth, while effectively managing liabilities can contribute to a stronger financial position. For example, substantial outstanding loans or unfulfilled contractual obligations directly diminish a company's net worth. Conversely, prudent management of liabilities, such as timely payment of debts or successful negotiation of contracts, can maintain or enhance net worth.

The importance of liability assessment extends beyond the immediate calculation of net worth. Accurate and ongoing evaluation of liabilities allows for proactive financial planning. Identifying potential future liabilities, like pending legal claims, empowers the company to proactively mitigate risks and prevent significant financial setbacks. Understanding liability trends, such as increasing or decreasing obligations, provides valuable insights into the company's financial health and operational efficiency. For instance, a consistently rising level of liabilities could signal inefficiencies in operations or unsustainable growth strategies. Conversely, effectively managed liabilities contribute to a stable financial foundation and a positive outlook for the company's future net worth. This knowledge is crucial for decision-making, such as strategic investments or future acquisitions.

In summary, liability assessment is not just a component of calculating net worth, but a vital aspect of overall financial health. Accurate identification and management of liabilities are essential for long-term financial stability and sustainable growth. Failure to properly assess liabilities can significantly impact the company's net worth, potentially leading to financial instability and decreased investor confidence. An understanding of the correlation between liability assessment and net worth is crucial for informed financial planning, strategic decision-making, and ensuring the long-term viability of Bob Ross Inc.

4. Profitability

Profitability is a critical driver of Bob Ross Inc.'s net worth. Profit, the difference between revenue and expenses, directly impacts the company's financial health. Sustained profitability generates resources for reinvestment, debt reduction, and expansion, ultimately enhancing net worth. Conversely, consistent losses erode assets, leading to a decline in net worth. A company with a history of profitability demonstrates a capacity for financial growth and stability, making it more attractive to investors. Conversely, persistent losses raise concerns about the company's long-term viability and future net worth.

The relationship between profitability and net worth is causal. Higher profitability, achieved through efficient operations, cost control, or strategic pricing, translates to greater retained earnings. These retained earnings can be reinvested in the company, expanding operations or developing new products, thus potentially increasing future revenue streams. This cycle of profitability and reinvestment is crucial for sustained growth. For example, a company consistently generating high profits can reinvest in research and development, leading to new product lines or improved production techniques, driving future revenue and enhancing net worth. Conversely, an inability to control costs or a decline in market demand can lead to losses, impacting net worth negatively.

Understanding the connection between profitability and net worth is vital for stakeholders. Investors assess profitability to gauge a company's ability to generate returns on investment. A strong track record of profitability suggests a more stable and potentially rewarding investment. Similarly, creditors examine profitability to evaluate a company's financial health and ability to meet its obligations. A company consistently reporting losses may be viewed as higher risk. For Bob Ross Inc. itself, consistent profitability demonstrates operational efficiency, a healthy financial position, and a sound basis for future expansion and growth. The company's ability to generate profits directly impacts its overall net worth and sustainable success in the long term.

5. Investment Returns

Investment returns are a critical factor in determining a company's net worth, including Bob Ross Inc. Returns on investments, whether from capital gains, dividends, or interest, directly impact the overall financial health of the entity. Positive investment returns typically increase the value of assets, thus enhancing net worth. Conversely, poor investment decisions or negative market conditions can diminish assets and correspondingly affect the net worth. The magnitude of this effect depends on the amount and type of investment undertaken.

The importance of investment returns as a component of net worth cannot be overstated. Successful investment strategies, leading to high returns, provide the company with resources for future growth, expansion, and operational efficiency. This is directly reflected in a positive trend in the net worth. For example, strategic investments in emerging markets or innovative technologies can yield substantial returns, significantly boosting the company's overall financial standing. Conversely, poor investments or misplaced capital can reduce the net worth, leading to financial instability. Careful consideration of investment opportunities, market analysis, and risk assessment are critical in ensuring a positive impact on net worth through investment returns.

Understanding the relationship between investment returns and net worth is crucial for various stakeholders. Investors assess the returns generated by a company's investments to evaluate its financial health and potential for future growth. A company consistently generating positive investment returns is generally viewed more favorably, attracting further investment. Creditors also consider investment returns to gauge a company's financial strength and ability to meet its obligations. A history of poor investment returns raises concerns about the company's long-term viability. For Bob Ross Inc. itself, successful investments in strategic initiatives, such as licensing agreements or brand extensions, will likely translate to positive returns and consequently, a stronger net worth. Conversely, ill-advised investments or a lack of strategic investment can negatively impact the company's financial position and overall net worth.

6. Market Trends

Market trends exert a significant influence on a company's financial health, including Bob Ross Inc.'s net worth. Fluctuations in consumer preferences, economic conditions, and competitive landscapes directly impact revenue generation, asset valuation, and operational costs. Favorable market trends typically correlate with increased demand for products or services, leading to higher sales, increased profitability, and a corresponding rise in net worth. Conversely, adverse market trends can depress sales, reduce profitability, and thus negatively affect the company's net worth. Understanding these connections is essential for informed decision-making and strategic planning.

The relationship between market trends and net worth is dynamic. For example, a surge in popularity for art supplies, coupled with a robust economy, would likely increase demand for Bob Ross-related products. This heightened demand would translate to higher sales, contributing to increased revenue and ultimately a stronger net worth. Conversely, a downturn in the economy or a shift in consumer preferences towards alternative art forms could depress sales, impacting profitability and, consequently, net worth. The influence of online retail platforms, for instance, is a critical market trend; if Bob Ross Inc. fails to adapt its sales strategies to utilize these platforms effectively, it may see a diminished net worth compared to competitors who embrace such avenues.

Analyzing market trends, such as evolving consumer tastes, technological advancements, and economic fluctuations, is crucial for evaluating a company's future prospects. A thorough analysis allows stakeholders to anticipate potential challenges and capitalize on emerging opportunities. For example, monitoring shifts in consumer preferences for specific art mediums, or the emergence of new competitors, enables proactive adjustments in product development and marketing strategies to maintain a strong position in the market, ultimately supporting a healthy net worth. Predicting and adapting to market trends is essential for a company's long-term success. Ignoring these trends can lead to a decline in net worth and a diminished market share compared to competitors who actively engage with these changes.

7. Historical Context

Historical context is inextricably linked to Bob Ross Inc.'s net worth. The company's current financial standing is a product of its past performance, market conditions, and strategic decisions made over time. Analyzing the company's trajectory through different economic eras and societal shifts reveals crucial factors that shaped its present financial position. Understanding this historical context is essential for evaluating the sustainability and potential future growth of the company.

The emergence of Bob Ross's distinct teaching style and the rise of the art-therapy movement in the 1970s and 1980s are prime examples. These periods provided the initial impetus for the creation of a recognizable brand. The subsequent evolution of media distribution, from television broadcasts to various online platforms, significantly impacted the company's revenue streams and market reach, with the net worth impacted by each era's economic circumstances and societal tastes.

Consideration of prior licensing agreements, lawsuits, and major marketing campaigns offers valuable insights into both successes and failures. These events profoundly shaped the company's financial landscape, creating assets or liabilities, impacting brand perception, and consequently affecting the calculated net worth. Examining past financial reports and market analysis from various historical periods reveals how changing market conditions and consumer trends impacted the company's revenue, expenses, and overall profitability. Without this historical lens, understanding the current net worth, as well as future potential, remains incomplete. Evaluating the company's responses to economic recessions, shifts in popular culture, and competitive pressures provides key insight into its resilience and ability to adapt, all of which are crucial factors in predicting future financial performance and influencing the company's current net worth.

In conclusion, historical context provides a critical framework for understanding Bob Ross Inc.'s net worth. By meticulously analyzing past events, market dynamics, and the company's responses to them, stakeholders can develop a more comprehensive understanding of the factors that contributed to the current financial position. This knowledge, in turn, is crucial for forecasting future trends, making informed investment decisions, and assessing the long-term viability of the company.

Frequently Asked Questions about Bob Ross Inc. Net Worth

This section addresses common inquiries regarding the financial status of Bob Ross Inc. Information presented is based on publicly available data and industry analysis.

Question 1: What factors primarily influence Bob Ross Inc.'s net worth?

Several factors significantly influence the company's net worth. Revenue from merchandise sales, licensing agreements, and potentially other income streams are key contributors. Asset valuation, particularly the brand's recognition and intellectual property, is also crucial. Conversely, liabilities, such as outstanding debts or potential legal obligations, decrease net worth. Profitability from operations, investment returns, and market trends all play a role in shaping the overall financial picture.

Question 2: How can I find information about Bob Ross Inc.'s financial performance?

Publicly available financial reports, if any, provide insights into the company's financial status. Industry analysts' reports, financial news outlets, and potentially investor relations materials can also offer information. Scrutinizing these resources, however, requires careful consideration of potential biases and the accuracy of the source.

Question 3: Is Bob Ross Inc.'s net worth a static figure?

No, a company's net worth is not static. It's constantly evolving based on various factors including market conditions, economic trends, and internal operational decisions. Net worth can fluctuate considerably over time due to these changing conditions.

Question 4: Why is understanding Bob Ross Inc.'s net worth important?

Understanding the company's net worth allows stakeholders, like investors and creditors, to gauge the company's financial stability and potential for future growth. This metric provides insights into the company's ability to generate profits and meet financial obligations. Furthermore, it allows for evaluating the potential risks and rewards associated with the business.

Question 5: How does Bob Ross Inc.'s net worth compare to similar companies in the art market?

Comparative analysis with similar companies in the art industry is possible if comparable data is available. Such a comparison would help in understanding the company's standing relative to its competitors, but would require a nuanced approach that considers individual revenue streams, brand distinctiveness, and market share.

Question 6: What are some potential risks associated with estimating Bob Ross Inc.'s net worth?

Several risks are associated with estimating a company's net worth, including limited access to confidential financial data. Market fluctuations, unpredictable changes in consumer preferences, and unforeseen legal issues can impact estimations. Consequently, reported estimates should be considered tentative and require rigorous scrutiny of the source and methodology employed.

A comprehensive understanding of Bob Ross Inc.'s financial situation necessitates careful examination of various factors impacting the company's net worth, such as revenue, assets, liabilities, and market conditions.

Moving forward, a detailed examination of the company's revenue streams, including merchandise sales and licensing, will be beneficial.

Tips for Evaluating Bob Ross Inc. Net Worth

Evaluating the net worth of Bob Ross Inc. requires a multifaceted approach. Understanding the factors influencing the company's financial position is crucial for assessing its overall health and potential. This section provides actionable tips for a thorough evaluation.

Tip 1: Analyze Revenue Streams. A robust and diverse revenue portfolio is vital. Assess the proportion of revenue derived from various sources, such as merchandise sales, licensing agreements, and potentially online ventures. A reliance on a single revenue stream leaves the company vulnerable to market fluctuations. Examine trends in revenue generation over time to gauge stability and growth potential.

Tip 2: Evaluate Asset Valuation. Accurate asset valuation is paramount. Assess the value of tangible assets like physical property and equipment. More importantly, focus on intangible assets such as the Bob Ross brand, intellectual property, and copyrights. Consider the impact of brand recognition, market trends, and potential legal challenges on asset values.

Tip 3: Scrutinize Liabilities. Detailed liability assessment is crucial. Evaluate the company's outstanding debts, contractual obligations, and potential legal liabilities. A high level of liabilities can significantly impact net worth. Examine trends in liabilities to identify potential financial strain. Assess the company's ability to meet its financial obligations.

Tip 4: Assess Profitability. Examine the company's historical profitability. Analyze the consistency of profits and the factors contributing to them. Sustained profitability indicates a healthy financial position and a capacity for reinvestment, which can enhance net worth. Evaluate the efficiency of operations and cost controls.

Tip 5: Consider Investment Returns. Analyze investment strategies and returns. Successful investments generate capital gains and strengthen the company's financial position, improving net worth. Assess the risks associated with different investments and the impact of market fluctuations on returns.

Tip 6: Evaluate Market Trends. Consider the market landscape. Analyze industry trends, consumer preferences, and competitor activities. The impact of technological advancements, evolving artistic trends, and economic conditions significantly impacts the company's potential revenue and profitability, thus influencing its net worth.

Tip 7: Factor in Historical Context. Consider the evolution of Bob Ross Inc. through different economic cycles and market environments. Understanding past performances helps identify recurring patterns, strengths, and weaknesses that may influence current and future financial trends.

Tip 8: Seek External Validation. Leverage industry analysis and financial reports from reputable sources. Use comparisons to similar companies in the art market to understand Bob Ross Inc.'s standing in the industry. This external validation provides a broader perspective on the company's financial health and net worth.

Following these tips allows for a more comprehensive and nuanced understanding of Bob Ross Inc.'s net worth. This multifaceted approach, incorporating a variety of factors, offers a more accurate and reliable evaluation of the company's financial position and potential.

A thorough evaluation of these factors is critical for a precise understanding of the company's net worth. This, in turn, informs informed investment decisions and strategic planning for the company and its stakeholders.

Conclusion

This analysis of Bob Ross Inc.'s net worth reveals a complex interplay of factors. Revenue streams, encompassing merchandise sales and licensing, play a pivotal role, with fluctuations in market demand and consumer preferences significantly impacting their stability. Accurate asset valuation, particularly of the Bob Ross brand and associated intellectual property, is essential for a precise determination of net worth. Conversely, careful assessment of liabilities, including debts and potential legal obligations, is crucial for a realistic financial picture. Historical context provides a crucial lens for understanding the company's trajectory and adaptability to changing market conditions. Profitability and investment returns are further key determinants, influencing the company's ability to reinvest and sustain growth. Finally, the impact of current market trends, such as evolving consumer preferences and the influence of online platforms, cannot be overlooked. Understanding these interacting factors is paramount for discerning the present value and future potential of Bob Ross Inc.'s financial standing.

A comprehensive understanding of Bob Ross Inc.'s net worth is critical for stakeholders. Investors seeking to evaluate investment opportunities, creditors assessing creditworthiness, and company executives developing strategic plans all benefit from this insightful analysis. Continued monitoring of market trends, strategic adjustments to revenue streams, and careful management of liabilities are crucial for sustaining and growing the company's long-term financial health. The insights gained from this exploration provide a valuable framework for informed decision-making and a more accurate assessment of the company's future prospects. Further analysis of specific financial data, including detailed breakdowns of revenue streams, asset valuations, and liability management, would offer more specific and nuanced conclusions regarding the company's financial health.