Locating a specific bank branch is a fundamental banking task. This involves utilizing various resources to pinpoint the physical location of a desired bank office. The process often entails referencing a map, online directory, or contacting the bank directly.

The ability to readily find a branch is crucial for a multitude of reasons. It allows for convenient access to banking services, such as depositing funds, withdrawing cash, and conducting transactions. This accessibility promotes financial ease and efficiency. Further, knowing branch locations enables customers to anticipate travel time and plan their banking activities accordingly. These benefits contribute to a positive and productive banking experience.

Methods for locating a bank branch vary, encompassing both traditional and digital channels. This article will delve into diverse avenues for discovering a desired bank branch. Topics discussed will include online search tools, bank websites, mobile apps, and potentially outdated physical directories.

How to Find the Branch of My Bank

Locating a bank branch is essential for accessing services and managing finances efficiently. Understanding the various methods for finding a branch enhances the banking experience.

- Online search

- Bank website

- Mobile app

- Geographic location

- Physical directory

- Customer service

- Branch locator tool

- Driving directions

Effective bank branch location relies on a combination of digital and physical resources. Online search engines can readily identify branches near a user's location. Bank websites often feature interactive maps and branch locator tools. Mobile applications offer similar functionality, facilitating access to branches on the go. Physical directories, though less common, still exist. Customer service representatives can provide accurate information about branch locations, even for less familiar areas. Combining online tools with a physical map helps ascertain branch accessibility, while driving directions facilitate the navigation process. A seamless experience requires understanding the different resources available, making the process practical and efficient.

1. Online Search

Online search engines are increasingly important tools for locating bank branches. Their versatility and accessibility facilitate swift and convenient identification of nearby financial institutions. This method leverages the vast network of online information, enabling users to quickly pinpoint relevant branches.

- Keyword Search Effectiveness

Employing relevant keywords significantly impacts the search results. Precise keywords, such as "bank branch," "credit union near me," or the specific bank's name, yield the most pertinent results. The use of location-based keywords like "bank branch [city name]" or "ATM near me" narrows down the results to nearby branches. Effective searches depend on concise and accurate wording.

- Integration of Maps and Location Services

Modern search engines often integrate maps and location services, displaying branch locations on interactive maps. This visual representation allows users to pinpoint physical addresses and evaluate the proximity of various branches. These features facilitate comparisons of branch distances and provide directions to help users navigate effectively.

- Accuracy and Up-to-Date Information

The accuracy of online search results for branch locations depends on the source's reliability and its adherence to real-time updates. Bank branch locations may change, requiring regular verification of data through official bank resources or reliable directories. Information retrieved from unreliable sources or outdated entries may lead to inaccurate results, highlighting the importance of confirmation.

- Filtering and Refinement Options

Advanced search engines commonly incorporate filters. These options permit users to narrow down search results based on specific criteria, such as bank type, services offered, or hours of operation. These filters can enhance search specificity and facilitate efficient comparisons of multiple branch options.

Online search offers a powerful platform for locating bank branches. Its multifaceted capabilities, from precise keyword searches to location-based mapping, enhance user efficiency. However, maintaining accuracy and the utilization of proper filters are key to obtaining reliable results. This combination of search tools, coupled with the reliability of data sources, makes online search an essential tool for discovering bank branch locations.

2. Bank Website

A bank's website serves as a crucial resource for locating branches. Its structure and content directly influence the efficiency and accuracy of this process. The website's design should provide readily accessible information regarding branch locations.

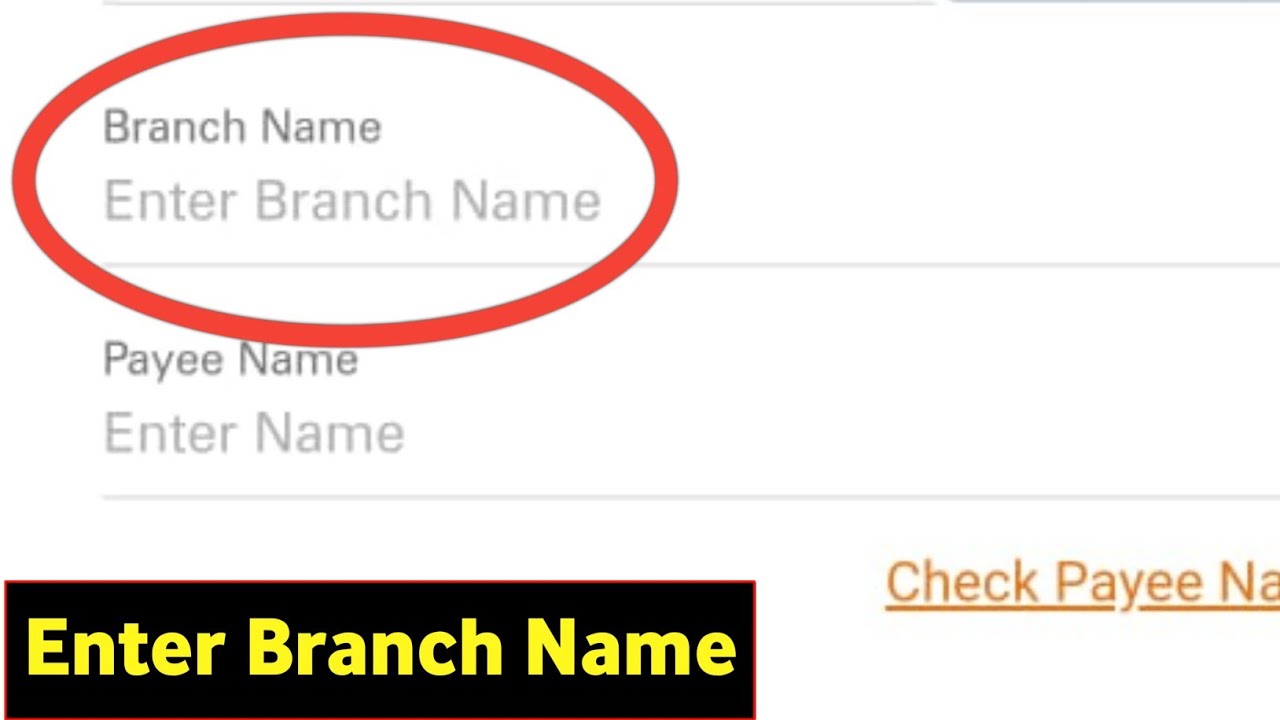

- Branch Locator Tools

Many bank websites incorporate interactive branch locator tools. These tools typically use maps, allowing users to input their location and identify nearby branches. Sophisticated systems often include filtering options, enabling users to refine their search by branch type (e.g., drive-through, ATM-only), hours of operation, or specific services offered. Accurate, up-to-date data are essential for these tools' effectiveness.

- Interactive Maps

Interactive maps integrated into bank websites provide a visual representation of branch locations. Users can zoom in and out on the map, view individual branch markers, and determine distances. Clear labeling, comprehensive details (e.g., address, contact information), and precise geographical positioning of branches contribute to the map's usability. The visual clarity facilitates easy selection of desired branches and associated navigation.

- Contact Information and Physical Addresses

Accurate listings of contact information (including phone numbers and email addresses) and physical addresses for each branch are vital. This information facilitates direct communication and enables users to physically locate a desired branch. The presence of clear, easily readable addresses and contact details directly contributes to the user's ease in accessing branch information.

- Branch Hours and Services

The display of branch operating hours is beneficial, as this allows users to determine operational times. Furthermore, listing specific services accessible at each branch (e.g., drive-through, ATM access, notary services) is advantageous. Knowing the specific services offered can guide users to the appropriate branch, enhancing the efficiency of their banking activities.

The effective utilization of a bank website for locating branches hinges on the functionality and comprehensiveness of its design. These features (locator tools, interactive maps, contact information, and service listings) combine to facilitate efficient navigation and selection of desired branches. By incorporating these elements, a bank website significantly improves the overall user experience associated with branch identification.

3. Mobile app

Mobile banking applications have become increasingly important in the modern financial landscape, offering convenient access to various banking services. A crucial aspect of these applications is their capacity to assist in locating bank branches, enhancing user convenience and efficiency.

- Branch Locator Functionality

Many banking applications include a dedicated branch locator feature. This functionality allows users to input their current location or specify a desired area, enabling identification of nearby branches. These features often incorporate interactive maps, providing visual representations of branch locations and facilitating spatial comparisons. Advanced applications might permit users to filter branches based on services offered, hours of operation, or accessibility needs.

- Real-time Data and Updates

Mobile banking apps frequently utilize real-time data feeds to ensure branch information accuracy. This continuous update process helps maintain consistent data on branch addresses, hours of operation, and contact information. Consequently, users can access up-to-date information regarding branch availability and service hours, contributing to a streamlined and efficient experience in finding desired branches.

- Navigation and Directions

Integrated navigation tools within these applications can provide detailed driving or transit directions to the selected branch. This functionality complements the branch locator, assisting users with the practical aspect of reaching a chosen branch. The ability to obtain and follow directions directly within the app streamlines the entire process from finding a branch to reaching it.

- Offline Functionality (for some features)

Some applications may enable certain features to operate offline. This may include storing a local copy of a branch directory, allowing users to search for branches even without an active internet connection. While not always applicable to all functions, this offline functionality is particularly helpful in areas with unreliable internet access, augmenting the reliability of the mobile app when used in those environments.

Mobile banking apps significantly enhance the process of locating a bank branch. The combination of real-time location services, interactive maps, and navigation features empowers users to efficiently identify and access desired branch locations, regardless of their current location. This convenience further strengthens the overall usability and effectiveness of mobile banking services.

4. Geographic Location

Geographic location is intrinsically linked to the process of finding a bank branch. Accurate location data is fundamental in identifying branches within a specific area, facilitating navigation and access to banking services. This crucial aspect considers the spatial relationship between the user's position and available bank branches.

- Determining Proximity

Knowing the user's current location is essential for identifying nearby branches. Utilizing location-based services, either through GPS or other geolocation methods, allows for the efficient determination of proximity to various branches. This allows for the prioritization of the closest branch, based on real-time distance metrics. The application of these metrics is crucial for optimal efficiency in finding the most appropriate branch.

- Mapping and Visualization

Geographic location data facilitates the visual representation of bank branches on maps. This visualization is instrumental in comparing branch locations and their relative distances. Interactive maps facilitate spatial analysis, highlighting the locations of different branches relative to the user's position. This visual representation is integral in understanding spatial relationships and making informed choices regarding branch selection.

- Addressing Accessibility Concerns

Understanding the geographic distribution of branches is important for addressing potential accessibility issues. Inadequate branch coverage in certain areas may necessitate longer travel times or the use of alternative service methods. Geographic data analysis can identify underserved areas and inform strategies for expanding branch networks to better meet community needs. Understanding the geographic concentration of branches can highlight gaps or disparities in service provision.

- Optimizing Branch Network Design

Analysis of geographic data plays a vital role in optimizing bank branch network design. Identifying areas with high population density and a shortage of branches can inform strategic expansion plans. Conversely, areas with sufficient branch coverage may necessitate a reassessment of their density or specific functions served. Employing these geographic insights can yield a more streamlined, efficient, and effective bank branch network.

The effective integration of geographic location data into branch finding methods provides a multifaceted approach to accessing banking services. By considering proximity, visualization, accessibility, and optimization, the user can make informed choices regarding branch selection. This data-driven methodology underscores the critical role of geographic location in shaping efficient and effective bank service delivery.

5. Physical directory

Physical directories, once a dominant method for locating bank branches, remain a viable, albeit increasingly obsolete, resource. Their historical significance as a primary source of branch information warrants consideration within the broader context of modern branch-finding strategies. A physical directory, typically a printed book or binder, provides a compiled list of bank branches, often organized by city or geographic region. This structured format allows users to readily scan and locate branches of interest. Prior to widespread internet access, directories often served as the definitive guide to financial institutions.

The practical application of physical directories is evident in their role as a tangible and readily available resource. In situations where internet access is limited or unavailable, such as remote areas or during disruptions to digital services, physical directories provide a practical alternative for finding branch locations. For instance, in a small community lacking robust digital infrastructure, a physical directory could offer a critical link to local financial services. However, their reliance on print and lack of up-to-date information often limits utility compared to digital alternatives. Examples include community libraries or post offices often maintaining local directories, offering a concrete pathway to locate specific bank branches.

While digital tools have largely supplanted physical directories as the primary method for locating bank branches, the historical context and potential for utility in specific circumstances must be acknowledged. The declining use of physical directories reflects the increasing prevalence of digital tools in modern society. Recognizing the potential limitations of printed directories, alongside the benefits of online tools, is crucial for a comprehensive understanding of contemporary methods for finding bank branches. The diminishing use underscores the changing landscape of information access and highlights the evolving relationship between technology and banking services.

6. Customer service

Effective customer service plays a critical role in locating a desired bank branch. A dedicated and knowledgeable staff can provide vital information regarding branch locations, hours of operation, and specific services. Direct communication with customer service representatives can streamline the branch-finding process, particularly in scenarios where online resources prove insufficient or outdated.

- Direct Inquiry for Specific Information

Customer service representatives possess direct access to real-time branch data, enabling them to provide precise, up-to-date information. This is particularly valuable when seeking details about specific branch services, hours, or accessibility features not readily apparent through online searches. For instance, inquiries about ATM availability, drive-through service, or specific transaction options necessitate direct contact.

- Branch Availability and Service Verification

Representatives can confirm branch operating hours and availability, addressing potential discrepancies between online information and the current status. This verification is crucial to ensure that planned visits are aligned with actual service offerings. Knowing the latest branch operating hours or whether a branch is temporarily closed due to circumstances is a key service customers expect.

- Problem Resolution for Locational Difficulties

In instances where locating a branch using online resources proves challenging or yields inaccurate results, customer service can provide alternative directions, guidance, or troubleshooting assistance. This support is paramount when difficulties arise from inaccurate or outdated online information, ensuring the customer's ability to reach the desired branch. The resolution of navigation problems is integral to ensuring customers' access to their desired location.

- Personalized Guidance for Specific Needs

Customer service agents can offer personalized guidance based on specific customer needs and circumstances. This assistance extends beyond the identification of a branch and potentially includes recommendations for the most appropriate branch given the customer's transaction type, preferred hours, or physical needs. Custom guidance caters to particular conditions or circumstances to enhance the user's bank experience.

In summary, customer service representatives serve as a vital supplementary resource for locating bank branches. Their expertise and access to current information allow for the verification and clarification of online resources, providing crucial support in cases of inaccurate or outdated information. This personal touch complements digital methods, ensuring a smooth and efficient banking experience, especially for those requiring specific information or facing difficulties with online tools.

7. Branch locator tool

A branch locator tool is a crucial component in the process of finding a bank branch. It directly facilitates this task by providing a centralized repository of branch locations. The tool acts as a nexus between customer need and branch availability, offering a streamlined means for users to identify desired branches. Its effectiveness hinges on the accuracy and comprehensiveness of the underlying data. Real-world examples abound; a customer needing a specific service can leverage a branch locator tool to pinpoint the nearest branch offering that service. This efficiency translates to time savings and convenience. The tool eliminates the need for extensive manual searches, facilitating a more practical approach to branch identification.

The practical significance of understanding branch locator tools extends beyond individual use cases. For financial institutions, these tools contribute to a positive customer experience, potentially boosting brand perception. By providing a straightforward method to find a branch, the institution demonstrates its commitment to accessibility and responsiveness. In turn, this responsiveness can translate into increased customer loyalty and satisfaction, driving a positive feedback loop. The effective implementation of a comprehensive and user-friendly branch locator tool contributes significantly to the financial institution's overall operational efficiency, ultimately saving staff time and resources by streamlining customer inquiries about branch locations.

In conclusion, a branch locator tool is intrinsically linked to "how to find the branch of my bank." Its efficacy stems from its ability to consolidate and present branch information in a readily accessible format. This approach not only serves the customer's immediate need but also reinforces the institution's commitment to providing convenient and reliable services. The impact of a well-designed branch locator tool extends beyond simple location; it underscores a fundamental aspect of modern bankingaccessibility and responsiveness. Challenges, such as maintaining the accuracy and timeliness of data, are inherent in managing such a tool. However, addressing these challenges ensures a seamless and satisfactory user experience. This understanding underscores the importance of considering the user journey when designing and implementing such tools.

8. Driving directions

Driving directions are an integral component of the process of locating a bank branch. Precise and accessible directions enhance the user experience by providing practical guidance for reaching a designated branch. This crucial aspect of branch finding facilitates efficient travel, minimizing time spent on navigation and maximizing the effectiveness of branch visits.

- Accuracy and Completeness of Data

Accurate directions are paramount. Inaccurate or incomplete directions can lead to wasted time and effort in finding the branch. Clear and concise directions with specific landmarks, street names, and turn-by-turn instructions contribute to a smooth and efficient navigation experience. The reliability of this data is fundamental to the user's satisfaction and the effective use of the information.

- Navigation Tools and Integration

Navigation tools, whether embedded within mobile applications or online platforms, play a crucial role. These tools leverage GPS data and real-time traffic information to generate dynamic driving directions, ensuring the most efficient route for the user. Integration with maps and real-time traffic updates enhances the tool's functionality and contributes to the user's ability to quickly and reliably reach a branch, accounting for real-world conditions. Clear and informative turn-by-turn instructions, based on real-time data, are paramount to efficiency.

- Handling Unexpected Roadblocks and Variations

Driving directions must account for potential road closures, construction, or unforeseen traffic situations. Robust systems anticipate these variables and offer alternative routes, ensuring the user reaches the branch efficiently and minimizing delays. Flexibility in the directions, especially when unexpected obstacles arise, is key to practical application and minimizing disruption.

- Considerations for Accessibility and Practicality

Directions should consider accessibility needs, such as providing options for physically impaired users. Clear, detailed directions, including visual cues and pedestrian-friendly pathways near the branch, are paramount in such instances. Practicality also includes the inclusion of potential parking information, ensuring that the user anticipates adequate parking options near the branch, thereby streamlining the visit.

The seamless integration of driving directions into the branch-finding process directly enhances the overall user experience. By incorporating these components (accuracy, navigation tools, handling roadblocks, and accessibility), the process becomes smoother, more reliable, and more user-friendly. Consequently, this comprehensive approach to driving directions significantly contributes to the overall success of locating a branch, enhancing the practical aspects of the customer journey.

Frequently Asked Questions about Finding a Bank Branch

This section addresses common inquiries regarding locating a bank branch. Accurate and timely information is crucial for a positive banking experience.

Question 1: How can I find the nearest branch to my current location?

Answer 1: Several methods are available. Utilize online search engines, incorporating keywords like "bank branch near me" or the specific bank's name. Many bank websites offer interactive branch locator tools, allowing users to input their location and identify nearby branches on a map. Mobile banking apps provide similar functionality, often with integrated navigation features. Finally, contacting customer service can provide specific branch details, including directions.

Question 2: How can I ensure the information I find online about branch locations is accurate?

Answer 2: Verify information from multiple sources. Online search results should be corroborated with the bank's official website. Check the bank's mobile app for any updated branch locations or operating hours. Customer service can validate specific details and confirm any discrepancies.

Question 3: What should I do if a branch's location on a map is incorrect?

Answer 3: Immediately report the error to the bank. Provide the inaccurate information, along with the correct details if known, to the appropriate customer service channel. Use the bank's website or mobile app to report the issue. Updating information is crucial to maintain accuracy and user trust in the accessibility tools.

Question 4: Are there physical directories still available to find a bank branch?

Answer 4: While physical directories are less common now, they may be available in some locations. Community libraries or post offices might hold such resources, especially in smaller communities. However, online tools are generally more efficient and up-to-date.

Question 5: How do I find branch hours of operation?

Answer 5: Check the bank's website, mobile app, or contact customer service. Website maps or branch locator tools often display operational hours. Using the bank's official channels guarantees the accuracy of hours and avoids potential errors from outdated or unofficial sources.

Question 6: What if I have specific accessibility needs regarding visiting a bank branch?

Answer 6: Contact customer service to discuss specific accessibility needs. Request information about the accessibility features and accommodations available at the desired branch. This will help ensure a positive and smooth experience during your visit, ensuring appropriate service for special needs. The bank should be prepared to accommodate all customer needs and provide a convenient banking experience for everyone.

Understanding the different methods for locating a bank branch allows for a more informed and efficient banking experience. The variety of available resources caters to various circumstances, and utilizing these resources strategically ensures ease of access to banking services. The accurate and prompt location of a desired branch is vital for efficient banking procedures.

The following section will delve deeper into specific strategies for locating a bank branch using online resources. A comprehensive understanding of these strategies will further enhance the customer's banking experience.

Tips for Locating a Bank Branch

Effective bank branch location relies on accessible and accurate information. Following these practical tips streamlines the process of finding a desired branch.

Tip 1: Employ Precise Keywords in Online Searches. Using specific and relevant keywords enhances search results. Instead of a general search, incorporate the bank's name, the desired location (e.g., "bank branch near Chicago"), and potentially the type of service sought (e.g., "ATM near me"). This approach refines the search and produces more targeted results.

Tip 2: Leverage Bank Websites. A bank's official website often features a comprehensive branch locator. Utilizing interactive maps allows for precise identification of branch locations and distances. These tools frequently enable filtering options, enabling refinement based on services offered, operating hours, or accessibility features.

Tip 3: Utilize Mobile Banking Applications. Modern banking apps often integrate a branch locator function. The application typically employs GPS data for real-time location services, providing users with a map view displaying nearby branches. Integrated navigation tools offer detailed directions for reaching the chosen location.

Tip 4: Contact Customer Service. Customer service representatives offer direct access to real-time branch information. This method is particularly helpful when online resources prove insufficient or outdated. Representatives can confirm branch hours, locations, and specific services, ensuring accurate and up-to-date details.

Tip 5: Check Physical Directories (Where Available). While increasingly obsolete, physical directories might still exist in local libraries or community centers. These directories provide a tangible list of branch locations, facilitating quick identification and geographic context.

Tip 6: Confirm Accuracy. Always cross-reference information from multiple sources. Inconsistencies between online listings and actual branch locations necessitate verification with the institution's official channels or customer support. This crucial step ensures reliability and minimizes potential errors.

Implementing these strategies optimizes the branch-finding process, ensuring access to required banking services. By leveraging the appropriate resources, individuals can efficiently locate a bank branch, minimizing travel time and maximizing the effectiveness of their banking activities. These tips directly contribute to a positive banking experience.

The succeeding section will delve into the various resources and strategies for locating a bank branch, providing a comprehensive overview of available tools and approaches. This expanded exploration will further enhance understanding and streamline the bank-finding process.

Conclusion

This article explored diverse methods for locating a bank branch. The process encompasses a range of options, from utilizing online search engines and bank websites to accessing mobile applications, physical directories, and direct customer service interactions. Accurate and up-to-date information is crucial throughout this process. The effective application of these methods minimizes travel time and ensures convenient access to banking services. Understanding the various tools and resources available enables a streamlined and efficient approach to locating the desired branch.

Accurate branch location data is fundamental to a positive customer experience. The reliability of information sources and the accessibility of these various methods contribute significantly to the overall efficiency of banking procedures. Future enhancements in branch location services may incorporate enhanced real-time data updates and personalized recommendations based on customer preferences and needs. Maintaining accurate and readily accessible information remains a critical factor in fostering customer satisfaction and ensuring a smooth and effective banking experience.