A check, marked as accepted by a financial institution, is a form of payment. This acceptance signifies that the funds represented by the check have been transferred to a bank account. The process of transferring funds from a check to an account involves endorsement and subsequent processing by the institution receiving the check. A critical aspect of this process is the successful clearing of the check, meaning verification of sufficient funds in the payer's account.

The act of entering a check into a bank account for processing has several benefits. It provides a convenient and secure method of receiving payment. It allows for a record of transactions and facilitates reconciliation of funds. Furthermore, a check's deposit enables the payee to immediately utilize funds, streamlining financial processes. The process of depositing checks ensures the account holder has a documented record of the transaction, crucial for tracking expenditures and receipts.

Understanding the intricacies of check deposits is fundamental to sound financial management. This understanding is vital in today's financial landscape, where many transactions are conducted via digital platforms. This article will further explore the implications and various aspects of handling and managing financial transactions, emphasizing the importance of accurate and timely processing of financial instruments.

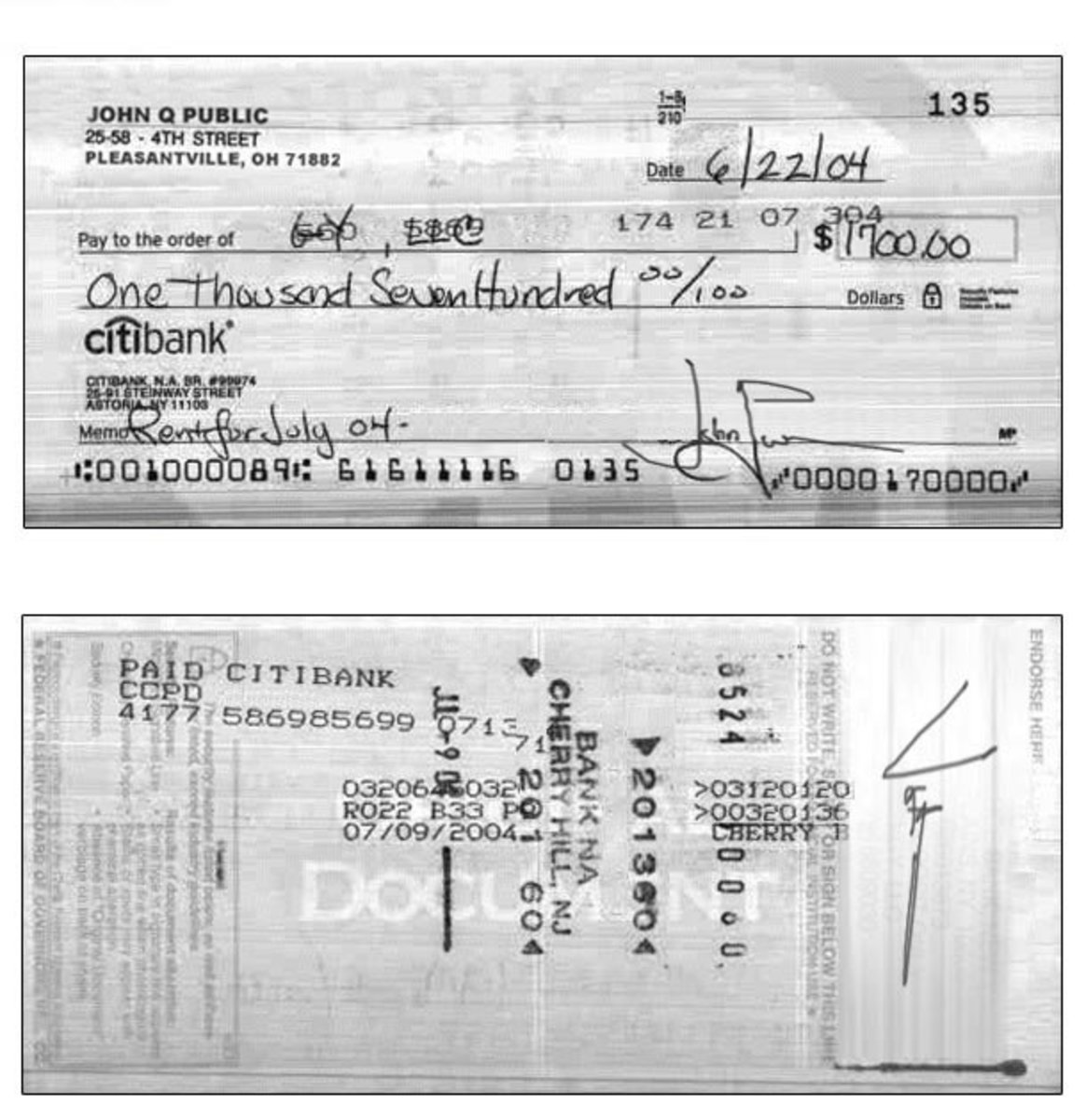

Deposited Check

Understanding deposited checks is crucial for sound financial management. This involves more than simply receiving payment; it encompasses a series of procedures and considerations.

- Payment method

- Account crediting

- Clearing process

- Transaction record

- Funds availability

- Fraud prevention

- Bank policies

- Reconciliation

A deposited check represents a transfer of funds. Account crediting records the deposit. Clearing verifies sufficient funds, and the transaction record provides documentation. Funds availability depends on the clearing time. Robust fraud prevention measures are essential. Specific bank policies govern deposit procedures. Reconciliation ensures accurate accounting. For example, a check deposited on Monday might not be available in the account until Wednesday due to the clearing process. Failure to reconcile account activity can lead to discrepancies and missed transactions. These key aspects work together to maintain accurate financial records and facilitate smooth transactions.

1. Payment Method

A payment method is fundamental to the concept of a deposited check. A check, itself a specific form of payment, becomes a deposited check only when the financial institution accepts it for processing. This acceptance signifies a transition from a physical instrument to an entry in the recipient's account. Exploring the various aspects of the payment method illuminates the mechanics of this transaction. Understanding this is crucial for managing financial records, ensuring funds availability, and safeguarding against fraud.

- Check Formalities

The check's physical form, including its proper completion with the correct details, payer address, date, amount, and signature, is essential. Errors or discrepancies may lead to the check being rejected or causing delays. Correct formatting, legible handwriting, and compliance with financial institution standards influence the prompt and seamless processing of the check.

- Endorsement and Acceptance

Proper endorsement by the payee is required for the check to be processed. The payee's signature signifies acceptance and authorization for the bank to transfer the funds. The bank's acceptance of the check signifies the initiation of the clearing process. This process involves verifying sufficient funds in the payer's account. Failure to endorse, or an incorrect or incomplete endorsement, leads to delays in processing.

- Clearing Process Integration

A crucial aspect of the payment method is the interplay between the check and the bank's clearing process. The bank verifies sufficient funds and then credits the payee's account. Delays or rejection during the clearing process are directly linked to the payment method's effectiveness. The time it takes for funds to appear in the recipient's account is directly influenced by the payment method's efficiency and the bank's internal procedures.

- Alternative Payment Methods

While a deposited check remains a significant payment method, other options are prevalent in modern commerce, such as electronic transfers, digital payments, or mobile wallets. Understanding the differing speeds and security protocols for different methods is vital for making informed financial decisions. A comparison of these alternatives to the deposited check highlights the evolving landscape of financial transactions.

In conclusion, the payment method, specifically when it involves a deposited check, encompasses the entire process from the creation of the check through to its processing and final entry into the payee's account. Each step in this process, from check form to clearing, affects the ultimate outcome and availability of funds. This meticulous method is essential for security and accuracy, and careful attention to these elements is critical for successful financial transactions.

2. Account Crediting

Account crediting, a critical component of the deposited check process, signifies the addition of funds to a bank account. The deposit of a check triggers this process. The check, a physical instrument representing a specific sum, undergoes verification and processing before the funds are credited to the account. This transfer of funds from the payer's account to the payee's account is contingent on the check's validity and sufficient funds in the payer's account. A successful deposit results in the credited amount reflecting in the payee's account balance.

The importance of accurate account crediting is paramount. Errors or delays can lead to financial discrepancies and cause significant inconvenience. For instance, if a check deposit is not credited correctly, the payee may not receive the intended amount, leading to a lack of funds for scheduled payments. Conversely, if the check is credited in excess of the amount written on the check, the payer may incur an unexpected loss. A delayed crediting can disrupt financial planning, as the anticipated funds may not be available when needed. The timing and accuracy of account crediting directly influence the financial activities of both parties involved. Furthermore, discrepancies in account crediting can hinder reconciliation and create opportunities for fraud, underscoring the importance of meticulous processes in handling deposited checks.

Understanding the connection between account crediting and a deposited check is essential for maintaining financial integrity. This understanding necessitates awareness of the procedures involved, from check endorsement to clearing processes. By appreciating the critical role of accurate account crediting as an outcome of a valid check deposit, individuals and businesses can safeguard their financial interests. The efficient and reliable crediting process ultimately facilitates smoother transactions and builds trust in the financial system, impacting the broader financial ecosystem.

3. Clearing process

The clearing process is integral to the functionality of a deposited check. It serves as the mechanism for verifying the validity of the check and authorizing the transfer of funds. A check, once deposited, enters this process, which involves several crucial steps. These steps ensure funds availability, preventing fraudulent activities, and confirming the transaction is legitimate. Without a robust clearing process, the reliability and security of check deposits are compromised. A delay or failure in the clearing process can result in a check being returned or a transaction being reversed.

The clearing process involves a series of interconnected activities. First, the depositing bank forwards the check to the payer's bank for verification. This involves examining the check's validity, ensuring sufficient funds exist in the payer's account, and confirming the payer's account is not flagged for any restrictions. The process often includes reconciling the check's amount against the payer's account balance. Second, the payer's bank verifies the check's authenticity. If discrepancies exist, the check is returned, and the deposit is not processed. Third, successful verification triggers the transfer of funds from the payer's account to the recipient's account. This entire process, from initiation to final transfer, is meticulously tracked through a standardized system to ensure accountability and facilitate reconciliation.

Understanding the clearing process is vital for maintaining financial integrity and preventing potential errors. A delayed or failed clearing process can lead to unforeseen consequences, such as bounced checks, missed payments, and disruptions in business operations. This understanding is essential for businesses and individuals alike. For example, a check deposited for a crucial payment, if not cleared promptly, may result in a failed payment, causing project delays or financial hardship. Conversely, knowledge of this process enables better financial planning and risk mitigation. This, in turn, highlights the importance of understanding the intricacies of deposited checks and the clearing process for both individual and organizational financial success.

4. Transaction Record

A transaction record, in the context of a deposited check, is a crucial component. It serves as a documented record of the entire process, from the check's presentation to the final crediting of funds. This record details the date, time, amount, and identifying information associated with the check. It also encompasses details like the payer's account number and routing information. The record's comprehensiveness is essential for various reasons, including reconciliation of account activity and the resolution of potential disputes. Without a detailed transaction record, tracing the movement of funds related to a deposited check becomes significantly more complex and time-consuming. A consistent, well-maintained transaction record provides a historical audit trail, allowing for a comprehensive overview of financial activity.

Real-world examples underscore the practical significance of transaction records. Consider a scenario where a check is deposited, but the funds are not subsequently credited to the account. A meticulously maintained record of the deposit transaction allows investigators to trace the steps involved in the process, helping identify where the discrepancy occurredwas the check returned, delayed, or incorrectly processed? This record becomes pivotal in resolving the issue and preventing similar problems in the future. In business settings, a detailed transaction record related to a deposited check streamlines auditing procedures and facilitates the reconciliation of bank statements. This meticulous record-keeping enhances financial transparency and enables businesses to maintain accurate financial reporting.

In conclusion, a transaction record associated with a deposited check is not merely a bureaucratic formality; it is a vital element in maintaining financial integrity. It facilitates accountability, promotes accurate record-keeping, and provides a crucial audit trail in case of disputes or discrepancies. A robust transaction record system is paramount for ensuring transparency and efficiency in financial transactions, directly impacting the overall reliability and trustworthiness of the financial system. Accurate and complete transaction records are fundamental to the security and stability of financial dealings, protecting all parties involved.

5. Funds Availability

Funds availability, a crucial aspect of the deposited check process, directly relates to the time frame in which the funds represented by the check become usable by the recipient. The availability of funds hinges on the clearing process, which verifies sufficient funds in the payer's account and the subsequent transfer of those funds to the recipient's account. This timeframe varies depending on the banking institutions involved and the specifics of the check processing. Understanding these variations is critical for managing cash flow and avoiding financial disruptions.

Several factors influence funds availability. The type of account held by the payer (checking, savings, or business) and the payer's payment history affect how quickly the funds clear. Similarly, the geographic distance between the payer's and recipient's financial institutions can impact processing time. Additionally, internal bank procedures and potential delays during the verification process can prolong the time until funds are available. For example, a check deposited on Monday might not be fully available in the recipient's account until Wednesday due to the time required for the clearing process. Delays can create financial challenges, as expected payments might not materialize when anticipated, impacting businesses' operational expenses or individuals' personal finances. Furthermore, incomplete or incorrect information on the check itself may cause delays, necessitating re-submission for processing.

Accurate estimation of funds availability is vital for sound financial planning. Awareness of the potential time lag between deposit and availability is essential for avoiding overdraft fees, missed payments, or disruptions to financial operations. For instance, a business expecting to receive payment on a specific date for an upcoming purchase may face difficulties if the funds are not available on schedule. Understanding funds availability, therefore, directly impacts financial planning, risk management, and operational efficiency. Knowing the typical clearing times for checks, understanding the various factors influencing availability, and using tools like online banking resources that provide visibility into funds availability are crucial steps in mitigating potential financial pitfalls. Recognizing that deposited check funds may not be immediately accessible is essential for prudent financial management.

6. Fraud Prevention

Protecting against fraud is paramount in the context of deposited checks. The process of depositing a check involves multiple points of vulnerability, making robust fraud prevention measures essential. These measures aim to safeguard both the payer and the payee, ensuring the integrity of financial transactions and minimizing potential losses. Careful consideration of various aspects is crucial.

- Check Authentication and Verification

Validating the authenticity of a check is paramount. This includes verifying the check's physical characteristics, such as the presence of security features, and confirming the signatory's identity. Forged signatures, altered amounts, and counterfeit checks are common methods of fraud. Advanced security measures and consistent verification procedures are necessary to detect and deter these fraudulent attempts. This involves scrutinizing the check's details against known records and employing advanced technologies.

- Background Checks and Account Scrutiny

Examining the payer's background and account history can help identify potential risks. Checking for previous instances of fraudulent activity, account discrepancies, or unusual transaction patterns is vital. Employing sophisticated algorithms to detect anomalies and flag potentially suspicious activities is a necessary component. Maintaining a vigilant approach is crucial in today's complex financial landscape to protect against increasingly sophisticated fraud schemes.

- Secure Handling and Storage Procedures

Implementing secure procedures for handling and storing checks is essential to prevent unauthorized access and alteration. This includes strict protocols for check handling, storage, and transportation. Implementing security measures, such as locked cabinets and controlled access areas, reduces the potential for tampering. Following these procedures minimizes risk exposure and helps retain the integrity of transaction records.

- Monitoring and Reporting Suspicious Activities

Establishing systems to monitor transactions and report suspicious activities can significantly reduce fraud attempts. Automated fraud detection systems, coupled with employee vigilance and regular checks, can identify potential irregularities. Prompt reporting of suspicious activities to the appropriate authorities allows for swift intervention and prevents larger financial losses. Early detection plays a vital role in containing potential harm.

Effective fraud prevention strategies are crucial for mitigating risks inherent in the deposited check process. By implementing these measures, financial institutions and individuals can maintain the integrity of financial transactions and safeguard against potential losses. A comprehensive approach, including robust authentication measures, diligent account checks, secure handling procedures, and vigilant monitoring of activities, is essential for protecting against fraudulent activities associated with deposited checks. This interconnectedness of these facets underlines the importance of proactive measures in the fight against fraud.

7. Bank Policies

Bank policies govern the processing of deposited checks, impacting every stage of the transaction. These policies dictate procedures for check acceptance, verification, and clearing, directly affecting the timing and security of funds transfer. Policies encompass everything from the format and endorsement requirements for acceptable checks to the procedures for handling potential discrepancies and fraudulent activities. The consistency and adherence to these policies ensure the efficiency and reliability of the entire process. For instance, a policy mandating specific endorsement procedures helps prevent fraudulent activity by ensuring the check's legitimate transfer. Similarly, policies defining the timeframe for clearing checks determine when funds become available to the depositor. These policies are a crucial part of the bank's internal controls to safeguard against losses and maintain the trust of customers.

Practical implications of these policies are significant. A bank's policy on check handling directly affects the rate at which deposited checks are processed. Strict adherence to policy concerning check endorsements minimizes the possibility of fraud, protecting the depositor and the bank. Policies regarding the resolution of disputes over checks ensure a standardized approach, leading to smoother resolutions and reduced customer complaints. Furthermore, policies concerning the handling of insufficient funds situations prevent the bank from accepting checks with insufficient coverage, protecting both the bank and the payer. Variations in these policies across banks create differences in processing times, impacting the overall efficiency of transactions.

In conclusion, bank policies related to deposited checks are fundamental to maintaining the integrity and stability of the financial system. These policies shape the entire process, from acceptance to clearing. Understanding these policies, including their explicit procedures and implied limitations, is crucial for individuals and businesses alike. Adherence to these policies, along with the necessary checks and balances, is paramount for efficient and secure transactions. By understanding the interplay between bank policies and the deposited check process, individuals and institutions can better manage their finances, mitigate risks, and navigate the complexities of financial transactions effectively.

8. Reconciliation

Reconciliation, in the context of deposited checks, is a critical process. It involves comparing records of deposited checks with corresponding bank statements to identify and resolve discrepancies. This process is essential for ensuring accuracy in financial records and preventing errors, safeguarding against potential fraud, and maintaining a clear understanding of account balances. Accurate reconciliation is crucial for all financial transactions.

- Identifying Discrepancies

The reconciliation process begins with comparing records. Discrepancies might arise from various factors. For example, a check might be deposited but not yet processed by the bank, resulting in a difference between the depositor's records and the bank statement. Similarly, errors in recording the deposit amount, memo descriptions, or the date of deposit can cause mismatches. Unreturned checks or entries for NSF (non-sufficient funds) checks also require careful attention. The key is identifying these differences meticulously.

- Tracing Transactions

Tracing transactions is a vital step in reconciliation. Carefully examining deposit slips, check stubs, and bank statements allows for the precise matching of individual transactions. For example, comparing the dates, amounts, and descriptions on these documents helps locate a missing deposit or an incorrectly credited amount. A thorough search through all records ensures no crucial information is overlooked, allowing the accurate identification of discrepancies. This meticulous examination is vital to understanding the transactions.

- Resolving Errors

Once discrepancies are identified, the reconciliation process aims to resolve them. If a deposited check is missing from the bank statement, it's essential to determine the reason for the omission. Was it a data entry error, a delayed clearing process, or even fraud? Effective communication with the bank, documentation of the issue, and correct entry in the appropriate accounts (debits or credits) are critical to rectify the problem. Discrepancies, if left unaddressed, can lead to significant financial problems.

- Maintaining Financial Integrity

The process of reconciliation fosters financial integrity. By identifying and resolving discrepancies, individuals and organizations maintain accurate records of their finances. This accuracy is critical in budgeting, forecasting, and making informed financial decisions. Precise reconciliation strengthens the foundation for sound financial management, enabling organizations to efficiently manage their funds and plan for future needs. This consistency also allows businesses to be accountable to stakeholders.

In summary, reconciliation of deposited checks is not simply a routine task but a process that upholds financial integrity. By carefully scrutinizing records, tracing transactions, and correcting errors, businesses and individuals can maintain accurate financial statements, preventing errors that might lead to financial losses and disruptions. The meticulous reconciliation process ensures that financial records align with actual transactions, providing a solid basis for decision-making and long-term financial stability.

Frequently Asked Questions About Deposited Checks

This section addresses common questions and concerns regarding the deposit of checks. Understanding these aspects is vital for maintaining accurate financial records and ensuring smooth transactions.

Question 1: How long does it typically take for a deposited check to clear?

Clearing time varies significantly. Factors influencing the timeframe include the payer's bank, the recipient's bank, and the geographic distance between them. Some checks might clear in a few business days, while others may take longer, depending on internal bank procedures and any potential issues. Online banking tools often provide estimated availability dates; however, these are approximations. Confirming funds availability directly with the financial institution is advisable.

Question 2: What should I do if a deposited check bounces?

If a deposited check is returned due to insufficient funds, the depositor should contact the payer immediately. The payer is responsible for rectifying the issue. Documentation of the returned check is crucial. The recipient should also consult the bank's policies regarding bounced checks and the procedures for re-deposit or alternative payment arrangements.

Question 3: What information should be included on a deposited check?

Legible endorsements and accurate details, including the date, amount, payer's name, and the recipient's signature or authorized agent's signature, are crucial. The check's appearance and correct completion are vital for smooth processing. Any discrepancies can delay or prevent the check from being processed correctly.

Question 4: Are there different types of check deposits?

Deposit methods vary by financial institution. Some institutions offer express deposit services, while others may have varying policies for overnight or same-day processing of checks. It is important to clarify these specific details with the financial institution handling the transaction.

Question 5: How do I reconcile my bank statement with my records of deposited checks?

Reconciliation ensures records accurately reflect bank statements. Compare deposit dates and amounts with bank statements. Look for discrepancies and document any differences. If discrepancies occur, contact the bank to clarify the status of the check. This process helps identify errors or omissions promptly and accurately.

Question 6: What steps can I take to prevent check fraud?

Vigilance is key. Inspect checks carefully before depositing them. Ensure proper endorsements and signatures. If a check seems suspicious, consult a financial advisor or the bank. Report any instances of suspected fraud immediately. Protecting against fraud involves a combination of vigilance, proper procedures, and reporting suspicious activities promptly to the relevant authorities.

A thorough understanding of these aspects of deposited checks ensures efficient and secure financial transactions.

The next section will delve into the specifics of check clearing processes.

Tips for Handling Deposited Checks

Managing deposited checks effectively is crucial for maintaining accurate financial records and avoiding potential issues. Following these practical tips ensures smooth transactions and protects against errors or fraud.

Tip 1: Verify Check Authenticity

Thorough examination of the check's physical condition is paramount. Look for inconsistencies in printing, alterations, or unusual markings. Ensure the check's signature matches the payer's known signature, preferably comparing it to verified documents. Examine for any indications of tampering. If any discrepancies arise, reject the check and contact the issuer.

Tip 2: Verify Sufficient Funds

Before depositing, confirm the payer's account balance. Contact the payer's bank or utilize online resources to ensure sufficient funds are available to cover the check's amount. This step prevents bounced checks and associated financial repercussions.

Tip 3: Maintain Accurate Records

Maintain detailed records of all deposited checks, including the date, amount, payer's name, and transaction details. Use a consistent system for recording information to enable accurate reconciliation of bank statements. This approach facilitates tracking and resolution of discrepancies.

Tip 4: Adhere to Bank Policies

Strict adherence to the bank's policies for check deposits is critical. Understanding the endorsement requirements, deposit procedures, and potential limitations is essential. Reviewing bank policies ensures compliance and efficient processing. This may include specific guidelines on handling multiple deposits or restrictions on certain check types.

Tip 5: Monitor Account Activity Regularly

Regularly monitor account activity to detect any anomalies. Using online banking tools to track transactions helps identify unusual deposits or withdrawals and potential fraud. Prompt recognition of discrepancies is crucial to minimizing losses.

Tip 6: Reconcile Bank Statements Frequently

Reconcile bank statements with internal records of deposited checks regularly. This practice helps identify any discrepancies promptly. Discrepancies detected through reconciliation can be resolved with the bank, preventing potential financial issues.

Key Takeaways: By diligently following these tips, financial institutions and individuals can improve the efficiency, accuracy, and security of deposited check transactions. These practices enhance the reliability of the financial system and safeguard against potential losses.

The subsequent section will delve deeper into the complexities of the check clearing process.

Conclusion

The process of depositing checks, a seemingly simple act, encompasses a complex interplay of procedures, security measures, and potential risks. From the initial presentation of the physical instrument to the final crediting of funds, a deposited check traverses a series of verifications, endorsements, and transfers. Key elements explored in this analysis include the various payment methods, the critical role of account crediting, the intricacies of the clearing process, the necessity of maintaining accurate transaction records, the varying timeframes for funds availability, and the paramount importance of fraud prevention. Understanding bank policies and the crucial reconciliation process are also highlighted as essential aspects of managing deposited checks. These interconnected facets are vital in ensuring the integrity, efficiency, and security of the financial system.

The security of financial transactions relies heavily on a robust understanding of the deposited check process. This understanding fosters accurate record-keeping, mitigates potential risks associated with fraud and errors, and ultimately enhances the overall reliability of financial systems. The insights provided highlight the importance of vigilance, careful record-keeping, and adherence to established procedures to ensure smooth transactions and avoid potential financial difficulties. A thorough comprehension of the entire process, from check authentication to the final reconciliation of accounts, is indispensable for responsible financial management in today's complex financial landscape. Continuous improvement in these practices will contribute significantly to enhanced security and efficiency within the global financial infrastructure.